The top 5 learnings before launching an Astaxanthin Product

Those who follow Lus Health Ingredients, online or offline, know we are big advocates of natural astaxanthin made from Haematococcus Pluvialis. Recently, we have posted a series on astaxanthin & sport nutrition, found here. Today, however, we would like to turn our attention to the astaxanthin market and what consumers enjoy about the product.

A health ingredient should have a solid foundation in science, but market dynamics and human emotion will be essential for a product to become successful.

2011 – WHEN THE MARKET JUMPED

We did not invent astaxanthin. Far from it. In fact, it has been in nature for millions of years. The (natural) ingredient itself was first developed for use in salmon feeds, before the launch of the cheaper, and from a health perspective ineffective, synthetic version. Luckily natural algae based Astaxanthin is used in human nutrition. Some great scientific minds in biology developed growing systems to effectively harvest the algae-based products. Now growing is one thing, selling is something else!

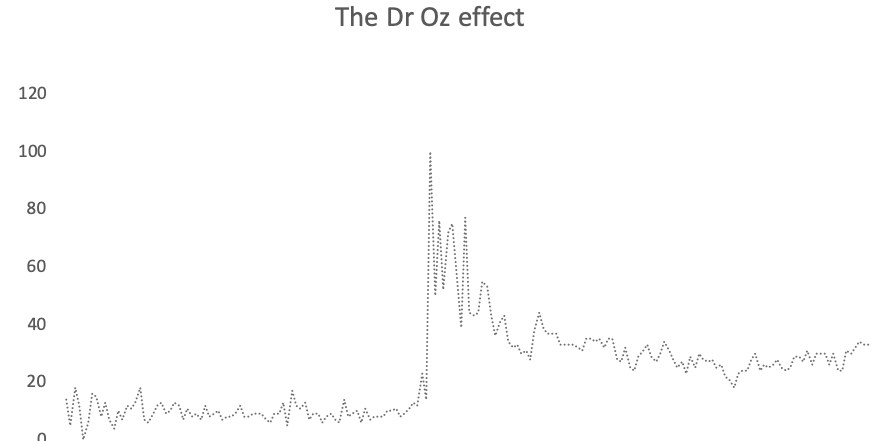

And then it happened…. in January of 2011 Dr Mercola appeared on the popular show Dr. Oz recommending Astaxanthin in the segment of the show called “The No.1 supplement you’ve never heard of and that you should be taking”.

What happened was an explosion of attention, also witnessed by a google trend score of 14 to maximum 100 instantly. The impact of the Dr Oz episode was a huge boost for the ingredient and for the sales of major brands.The initial jump in trend score wore off, but always stayed more popular than before 2011. If we compare these data across European countries (with the word Astaxanthin in the local language), it became evident that no country, besides the UK, showed a “Dr Oz – effect”.

For those who are new to google trends, the scale is based upon searches on a term (in this case Astaxanthin) and is a relative scale. Meaning the maximum searches in one specific month (from 2004 onward) = 100%. If we look at the graph above, it seems that the popularity growth in the UK and Germany for astaxanthin is slow but steady and increasing over the last years. Whether the increase in search term popularity is also linked to an increase in sales, like seen in 2011 in the USA, is a likely impact.

2019 – CURRENT MARKET ANALYSIS

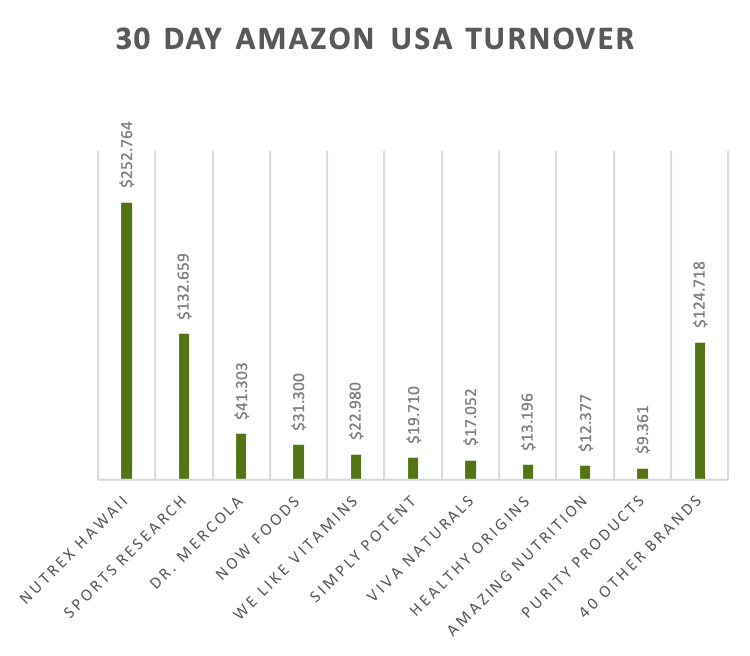

There are many brands that sell astaxanthin, pure in a soft gel, or in a formulation. Next to this we see many channels, both on & offline. For the specific market analysis below, we have used US based Amazon data and only for supplements that position astaxanthin as a single ingredient in soft gels. We have collected the inputs through JungleScout, and these are based upon the full month of May 2019.

In May 2019 the top 50 brands totaled around 800k USD of sales. The top 2 by itself, Nutrex & Sports Research do together nearly 50% of this turnover, talk about the power of branding!

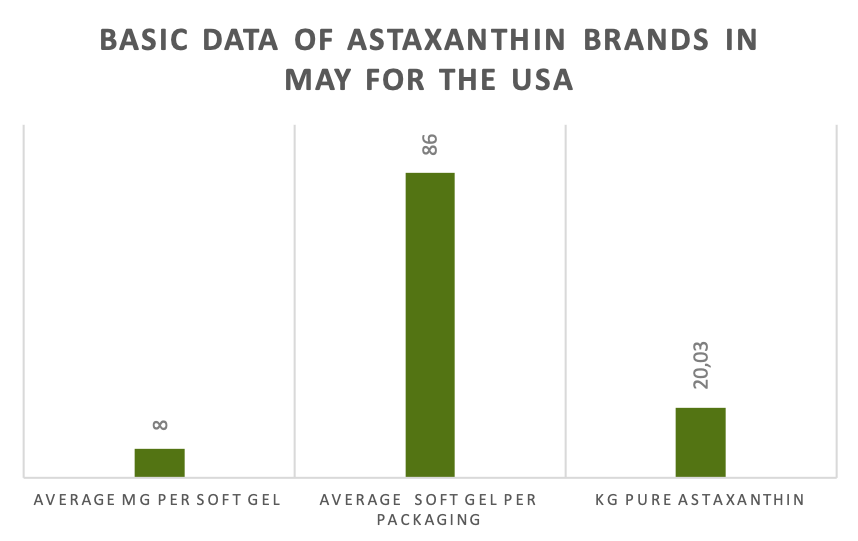

If we further analyze the collected data we can also get a feel for the differences of the brands & products. The average amount in a soft gel is roughly 8mg, though there is a spread between 4-12mg seen. Eight milligram is actually the maximum allowed daily dosage in Europe though safety studies do not indicate harm above that. The current upper limit in the USA is 12 mg / day.

The amount of soft gels per packaging is highly variable from 30 to 180, though most brands have a 60 or 90 soft gels with an average of 86. This gives, apart from brand value, an enormous variety (of prices) to consumers, something we like to call price confusion. Price confusion allows multiple price positionings even within one brand. Now let’s do some math here, if we take the average amount in a soft gel, multiply that by the number of soft gels per packed unit and the sales in the month of May, we get to 20kg of pure Astaxanthin in one month of sales on Amazon alone. Big question of course, what are the sales in other channels? If you read this and would like to share your thoughts please do!

PRICE

Is price important for Astaxanthin you wonder? At first glance we would say YES, we all like a good deal, don’t we?

But what makes a good deal for your health and how do brands play a role in that? We believe that a good brand represents values & beliefs that resonate with the customer far beyond the product. Buying is emotion and feelings of trust are critical to make any (first) sale. So, let’s take a look at pricing brackets, as shown in the figure below. The data we collected we expressed as the price per kg of pure astaxanthin. This has some flaws to it as smaller packages are usually more expensive (vs the content you get). Packaging does costs money. We felt, however, this would be a good way to compare all products 1 on 1.

As is demonstrated from the figure below the highest number of products positioned into the market are those at the lowest value, nearly 40% fall into that first bracket, followed by 27% in the second bracket which positions the retail value of pure Astaxanthin around 41.000-71.000 USD per kg. Other price positioning are much less popular, but are going as high as 180,000 USD/kg.

So now that we know about the price positionings on the market, which one is most successful? Meaning creates most turnover? To find the answer, we did two separate analyses. First, we looked at the brackets as above and scored the total value they presented, as can be shown below. It gives a solid picture 80% of all turnover made is in the cheapest category. That’s it. Make it cheap and it sells. However….

If you do a like for like analysis, basically revealing what is actually IN the first bracket, this relationship is totally lost and for good reason. Actually, two good reasons, they are called Sports Research & Nutrex Hawaii, both trusted brands, which we will analyse later on in this report. These two brands are both positioned around 40,000 USD/kg pure astaxanthin retail price – just in the first bracket – and outweigh all others.

For those of you wondering what will happen if you remove these two brands “as outliers”, the answer is: nothing, i.e. it does not improve the relationship between turnover & price. In other words, if you currently have an astaxanthin brand, or are thinking about launching one, be around that 40,000 USD/kg pure – mark and focus on branding.

HEALTH PERCEPTION

Those of you know Lus Health Ingredients, know that we love astaxanthin. Not because it is red, grown sustainability but mostly because of the impact on our health. We believe there is substantial amount of science showing health benefits, however, this is not enough to currently substantiate official health claims in Europe.

So can we then talk about what self-reported benefits consumers experience? I think so!

We have taken our two top brands, as mentioned above, and have looked at reviews. Not all, as these products are highly reviewed, with high scores (4,7 average, two brands totaling over 3300 reviews). We have taken a sample of one hundred 5-star ratings that self-acclaim a health effect and found some interesting facts.

If we take the data for the Nutrex Hawaii brand, as shown below, over 34% of consumers report an improvement of joint problems, followed by improvements in vision / eye health (20%) and a decrease in sunburn (19%). These coincide with study results over the years, which might for most consumers the REASON why they started buying it in the first place.

From the Sport Research review data we see the same top 3 appear, though with slightly different numbers. Skin comes out as a 4thcategory (15%). When doing this analysis we believed that the audience for both brands (Nutrex more positioned with regular supplement takers and Sport Nutriton more on athletes) would impact the findings much more dramatic as we have seen here. E.g. the total self-reports of improvements on Stamina, Energy recovery after sports are nearly similar (12 vs 14%).

CONCLUSIONS

While you were reading this some points might have already become clear. You want to position you (new) astaxanthin product on the market? Then consider the following from this report:

1. Effective communication of science is important, like seen by the Dr. Oz case

2. Astaxanthin search trend in Germany & UK are increasing, this might be the right time to launch in Europe!

3. Branding is more important than pricing

4. Be around a retail price of 40,000 USD/kg pure Astaxanthin, but too much not higher

5. Consumers report benefits on eye, skin (burn), joints and others. Consider what are your current customers looking for, why they buy from you and what the demographics are?

Get in touch with us to find out more, we offer help in your product design from scientific, market and consumer data perspective to give you the best possible chance of success, the rest is up to you.

About Lus Health Ingredients

We are a young and dynamic B2B company from The Netherlands that believes in the power of natural & plant-based products. Our mission is to inspire those around us to make healthier & more sustainable choices, so we may all benefit. Follow us on Linkedin, visit our website or get in touch directly info@lusingredients.com.

Lus Health Ingredients represent Atacama Bio Natural in Europe, one of the key producers in the world of Natural Astaxanthin with their brand NatAxtin™. Their privileged location in the Atacama Desert enables a low cost, sustainable, environmentally friendly, and most-close-to-natural technology to produce Astaxanthin as nature intended.

The data used to construct our report is based upon our Amazon.com analysis for the USA and Amazon in Europe by interpretation of Germany, France, UK, , Spain, Italy and is a snapshot from the last 30 days. This is done using the JungleScout extension. Google trend was used for global & local trends, whereas consumer review data was analyzed “by hand” through real reviews on Amazon.com.